MARI MARI MARI (Come, Come, Come),

MARI MARI MARI (Come, Come, Come),MARI BAYAR SAMAN (Pay your summons),

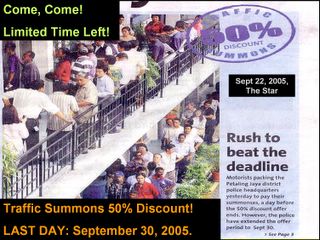

SPECIAL DISCOUNT UP TO 50% for traffic offenders!

ENJOY THIS SPECIAL PRIVILEGE NOW!

DISCOUNT OFFER EXTENDED TO 30th SEPTEMBER 2005!

The Police have been gracious of late. They are giving up to 50% discounts to traffic offenders if they pay up their summons by 23rd September 2005.

However, due to the tremendous response, the police had decided to extend the dateline to 30th September so that the public can take up this special offer.

It is interesting to note that the government had been extremely innovative and creative in looking into ways to increase their revenues.

This may have stem from the fact that the government may be facing shortfall in financing development expenditures and at such, have made various initiatives to increase their coffers through the aggressive issues of summonses and then coming up with an aggressive promotion packages to enhance collections. It has been estimated that these summonses will generate hundreds of million, probably sufficient to pay for some new projects in Putrajaya or to use it to revive some government projects.

If they can collect something like, RM20 billion or more, then perhaps, the government can even consider to revive the Double-Track Railway project previous awarded to MMC-Gamuda.

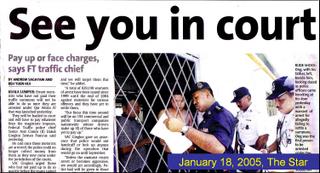

The police would be encourage to maximise and optimise the issue of summonses and maybe, the public will also be encourage to help generate the summonses.

In the year 2004, the Inland Revenue Board (IRB) exceeded their targeted RM50bil revenue as reported by their chief executive officer Tan Sri Zainol Abidin Abd Rashid. In 2003,, the IRB collected some RM42.8bil in tax revenue, an amount Zainol said was surpassed. IRB are extremely confident of passing the RM60 million mark for the year of 2005. Some 43% of the national budget is currently financed from income tax and another 23.5% from indirect taxes.

In the year 2004, the Inland Revenue Board (IRB) exceeded their targeted RM50bil revenue as reported by their chief executive officer Tan Sri Zainol Abidin Abd Rashid. In 2003,, the IRB collected some RM42.8bil in tax revenue, an amount Zainol said was surpassed. IRB are extremely confident of passing the RM60 million mark for the year of 2005. Some 43% of the national budget is currently financed from income tax and another 23.5% from indirect taxes.

However, due to the tremendous response, the police had decided to extend the dateline to 30th September so that the public can take up this special offer.

It is interesting to note that the government had been extremely innovative and creative in looking into ways to increase their revenues.

This may have stem from the fact that the government may be facing shortfall in financing development expenditures and at such, have made various initiatives to increase their coffers through the aggressive issues of summonses and then coming up with an aggressive promotion packages to enhance collections. It has been estimated that these summonses will generate hundreds of million, probably sufficient to pay for some new projects in Putrajaya or to use it to revive some government projects.

If they can collect something like, RM20 billion or more, then perhaps, the government can even consider to revive the Double-Track Railway project previous awarded to MMC-Gamuda.

The police would be encourage to maximise and optimise the issue of summonses and maybe, the public will also be encourage to help generate the summonses.

In the year 2004, the Inland Revenue Board (IRB) exceeded their targeted RM50bil revenue as reported by their chief executive officer Tan Sri Zainol Abidin Abd Rashid. In 2003,, the IRB collected some RM42.8bil in tax revenue, an amount Zainol said was surpassed. IRB are extremely confident of passing the RM60 million mark for the year of 2005. Some 43% of the national budget is currently financed from income tax and another 23.5% from indirect taxes.

In the year 2004, the Inland Revenue Board (IRB) exceeded their targeted RM50bil revenue as reported by their chief executive officer Tan Sri Zainol Abidin Abd Rashid. In 2003,, the IRB collected some RM42.8bil in tax revenue, an amount Zainol said was surpassed. IRB are extremely confident of passing the RM60 million mark for the year of 2005. Some 43% of the national budget is currently financed from income tax and another 23.5% from indirect taxes.

Even State Governments are also making extra efforts to increase their coffers.

Even State Governments are also making extra efforts to increase their coffers.Recently, the Selangor Government imposed new requirement to all property developers requiring them to register with Lembaga Perumahan dan Hartanah Selangor (LPHS) and pay a registration fee of 0.1% of their gross development value.

Developers are already registered with the Ministry of Housing and Local Govt and an additional layer will be burdensome. However, the State government are adament as this is a way to parade their progressive Key Performance Indices to prove to the Prime Minister that there are efficiency and effective in their executive management and revenue enhancement efforts.

The new requirements also include regulations on Bumiputra lots to be predetermine by LPHS on the developer’s layout and building plans while another ruling requires the developers to deposit 40% of the overall development cost of a project in a bank before approval is given for land conversion.

"New regulations and requirements slapped by Selangor’s authorities are costly, duplicative and bureaucratic, as builders already face enough Federal legislation," the Real Estate and Housing Developers’ Association (REHDA) said.

“Malaysia’s housing industry is already one of the most regulated in the world,” said Datuk Jeffrey Ng Tiong Lip, REHDA President.

In the wake of rising fuel prices, Human Resources Minister Datuk Dr Fong Chan Onn has instructed that government offices reduce air-conditioner use to save energy. Fong reckons this will help the Government save energy, and reduce expenditures and would also built an energy-saving culture.

In the wake of rising fuel prices, Human Resources Minister Datuk Dr Fong Chan Onn has instructed that government offices reduce air-conditioner use to save energy. Fong reckons this will help the Government save energy, and reduce expenditures and would also built an energy-saving culture."We have to teach the public to consume energy more efficiently.“ He said circulars would be sent out advising the management to go slow with air-conditioner usage.

Fuel prices rose between five and 20 sen per litre recently, following the Government’s move to cut back on subsidies as crude oil prices continue to soar globally.

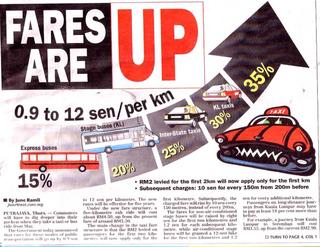

The Klang Valley Taxi Operators Association said the rise in fuel prices was not good for the public transport sector, especially for taxi operators who pay sales tax for each vehicle they buy. Its president, Abdul Jalil Maarof, hoped the Government would abolish the 10 to 12 per cent sales tax to compensate for the rise in prices.

The Klang Valley Taxi Operators Association said the rise in fuel prices was not good for the public transport sector, especially for taxi operators who pay sales tax for each vehicle they buy. Its president, Abdul Jalil Maarof, hoped the Government would abolish the 10 to 12 per cent sales tax to compensate for the rise in prices.In April, the Government announced that rates for public transportation will go up by 0.9 sen to 12 sen per kilometre. Under the new fare structure, a five-kilometre cab ride will cost about RM4.50, up from the present fare of around RM3.50. The main change in the taxi fare structure is that the RM2 levied on passengers for the first two kilometres will now apply only for the first kilometre. Subsequently, the charged fare will rise by 10 sen every 150 metres, instead of every 200m.

So, no mega projects, civil service department and statutory bodies are now looking into ways to generate revenues by increasing taxes, duties, licences, fees, summonses, introduce new regulations and registrars that can collect more fees, certifying and accrediting bodies that can also collect tithes and membership fees, etc, etc.

I wonder if it cross your mind that, maybe, maybe, maybe,

Mahathir had made a mistake; I ponder!

I wonder if it cross your mind that, maybe, maybe, maybe,

Mahathir had made a mistake; I ponder!

2 comments:

I don't agree with discounted payments for traffic offences.

The message being given is that the police cannot find you to arrest you.

Bad for the long term.

Suggest you include the "type-in" feature to prevent spam in your interesting blog.

Hi Angus,

Thanks for your suggestion but I am illiterate on what is "type-in" feature .

Post a Comment