EPF dividend

12th. February 2005, NST reports:

The NST reported today that EPF members can expected a slightly higher dividend for the fiscal year 2004. It was reported that the dividend could be 4.75%. A fund manager said that a 4.75% dividend should be reasonable given the fact that the bulk of EPF’s assets (approx. RM240 billion overall fund size) were in fixed asset income.

MTUC congress delegates in the last month’s triennial conference had criticized and questioned the EPF’s handling of employees’ contributions, which they said had resulted in dividends dropping in recent years. “We want to emphasize our stand that EPF should not be used to rescue companies that are likely to go bankrupt,” MTUC president Syed Shahir Syed Mohamud said.

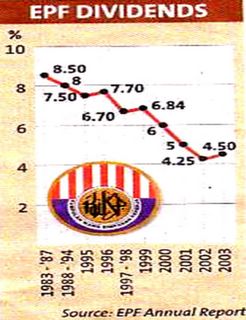

For the record, EPF dividend for the period between 1983 to 1994 was around 8% and the worse dividend was in the year of 2002 which was 4.25%. In 2003, EPF declared 4.5% dividend. So, if they declare 4.75%, it means EPF had improved, is it?

With a new CEO and the introduction of the KPI and Balance Scorecard system, I wonder if EPF would publish its scoring system, the key performance indices and how the performance are measured and benchmark.

Will Pak Lah comment on his initiative and the results of introducing the KPIs and Performance Meausrement System.

Mediocrity breeds mediocrity and it is something we often boast of.

No comments:

Post a Comment