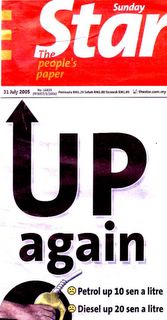

Fuel Uped!

Fuel prices have gone up again for the 3rd time in this year. The Government announced late last night that petrol price was up by 10 sen a litre and diesel, 20 sen a litre. The retail price of liquefied petroleum gas (LPG) has also gone up by five sen per kg.

The increase, effective today, comes just over two months after the May 5, 2005 increase. On 1st March 2005, the government increase the price of diesel and petrol by five sen per litre.

“We have to be prudent in managing our finances and we have to be realistic. We have been absorbing the cost of petrol for a long time, even when oil prices were as high as US$64 (RM243) per barrel,” Domestic Trade and Consumer Affairs Minister Datuk Mohd Shafie Apdal said.

The statement from the department said the decision to increase the price of fuel was to overcome the impact of rising crude oil prices and to curb the increase in subsidies paid by the Government. With the price increase, it said total financial loss would be reduced from RM15.43bil to RM14.48bil, a savings of RM955.9mil. The Government added that the subsidy on petroleum products last year was RM4.8bil.

“The Government’s stand is to ensure that the prices of essential goods are at an affordable level and at the same time, reduce inflation,” it said. It said the Government was aware that the increase in retail prices of petroleum products could result in people taking advantage of the situation and engaging in profiteering. The statement said that while the Government stated that subsidies would not be revoked, it would at the same time not be able to continue shouldering increasing subsidies.

Will this increase fuel inflation? We will have to hear the reactions from transporters and manufacturers in the next few days. There is no question that the cost of crude oil has reach USD60, an increase of USD10 since May 2005. But Malaysia is a net exporter of crude oil and we have gained much from the high price through taxation from Petronas and royalties. If the price of crude is USD30, then Petronas profit would not have doubled, and would not have paid RM31 billion taxes and royalties. Would the raise in price be justified?

For the record, Petronas contributed RM31.2bil (for the year ending March 2005) to the Government in the form of dividends, royalties, taxes and export duties. This amounts to more than half of its pre-tax profit of RM59bil.

On the whole, about 25% of the Federal Government’s income is derived from Petronas, without which the Government would be denied a substantial source of income for development projects.

We just have to hope that the government is prudent in their spending. Is it wishful thinking? I hope not!

No comments:

Post a Comment