EPF

Only 1,138 opted to keep their savings and withdraw only annual dividends.

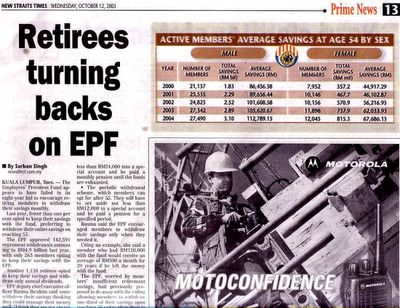

Last year, fewer than 1% opted to keep their savings with the fund, prefering to withdraw their entire savings on reaching 55.

The EPF appears to have failed in its 8-year bid to encourage retiring members to withdraw their savings monthly.

EPF deputy chief executive officer Rusma Ibrahim said some withdrew their savings thinking they could manage their money well.

Rusma: “I think they are not always correct.”

“Members had no reason to withdraw all their savings if they had paid off their mortgages, were in sound health and had no children pursuing tertiary education."

Rusma said the EPF encourage members to keep their savings with them as they could earn an average of RM500 a month for 20 years if they leave an amount of RM120,000 with the fund.

$500 earnings a month and that works out to be $6,000 a year income from EPF if you have $120,000 savings with EPF. It's 5% per annum dividend; uncompounded!!!

Dear Rusma, 5% and you think EPF is doing a good job for contributors?

I will put my money in a Bond Fund anywhere, at any Bank, and I will earned between 7 to 10% annually, and on top of that, I will receive bonus and yearly dividends.

In the 80s, EPF were paying between 8-9% dividends; now, for the last 7 years, they are paying 4-5%; are they still saying they had been competent?

I had known how the system works. They would work their investments to a set target of 6% ROI and then, the system will hybernate so that it would not surge to ROI of 8-10%. Once the 6% is achieved, say within 4-6 months of the financial year, then most of the assets parked at volatile higher-return/risk investments (such as equity, forex and foreign equity tradings) will be re-allocated and park at risk-free investments such as government-guaranteed securities or projects, Cagamas, (100% secured investments). The investment system in EPF is generally capable to achieve 6% within a six month period. If EPF allows the system to invest effectively, they would possibly achieve something like 8% to 10% ROI. Then, the following year, the system will have to be benchmarked at the higher ROI, and the investment managers will be stressed to perform and achieve at higher ROI, or at least to repeat similar performance. Of course, investment in higher return derivitives will be exposed to higher risk, which is a phobia within the institution. At such, EPF had chosen the easier way to maintain stability and safe returns on investment. They are basically risk-averse.

They call it BALANCE SCORECARD - don't score too high (play safe in order to be safe); Otherwise, they will be in trouble the next year as they will have to maintain a higher level of returns.

This is what Malaysians learnt - BALANCE SCORE-SHEET; NOT SCORECARDS!

Read an article from aisehman.org and maybe, EPF should come up with a better explanation:

On paper, [EPF's] roughly RM2.3 billion investment in listed Rashid Hussain Bhd is currently valued at about RM115 million , according to people familiar with the matter, making the investment one of the worst in the EPF's history. [Wall Street Journal: Another chill hits Malaysian business climate; subscription required]

At the crux of the affair is the dire financial health of RHB Bank's ultimate holding company, Rashid Hussain Bhd, in which Utama and the EPF own 32.8% and 31.7% stakes, respectively. Malaysian bankers say the Rashid Hussain group of companies urgently needs at least RM3 billion of fresh capital from its main shareholders to meet government capital-adequacy requirements.

The problem: The EPF would have to pour more of public funds into an already disastrous investment in order to bail out the group.

Only 1,138 opted to keep their savings and withdraw only annual dividends.

Last year, fewer than 1% opted to keep their savings with the fund, prefering to withdraw their entire savings on reaching 55.

The EPF appears to have failed in its 8-year bid to encourage retiring members to withdraw their savings monthly.

EPF deputy chief executive officer Rusma Ibrahim said some withdrew their savings thinking they could manage their money well.

Rusma: “I think they are not always correct.”

“Members had no reason to withdraw all their savings if they had paid off their mortgages, were in sound health and had no children pursuing tertiary education."

Rusma said the EPF encourage members to keep their savings with them as they could earn an average of RM500 a month for 20 years if they leave an amount of RM120,000 with the fund.

$500 earnings a month and that works out to be $6,000 a year income from EPF if you have $120,000 savings with EPF. It's 5% per annum dividend; uncompounded!!!

Dear Rusma, 5% and you think EPF is doing a good job for contributors?

I will put my money in a Bond Fund anywhere, at any Bank, and I will earned between 7 to 10% annually, and on top of that, I will receive bonus and yearly dividends.

In the 80s, EPF were paying between 8-9% dividends; now, for the last 7 years, they are paying 4-5%; are they still saying they had been competent?

I had known how the system works. They would work their investments to a set target of 6% ROI and then, the system will hybernate so that it would not surge to ROI of 8-10%. Once the 6% is achieved, say within 4-6 months of the financial year, then most of the assets parked at volatile higher-return/risk investments (such as equity, forex and foreign equity tradings) will be re-allocated and park at risk-free investments such as government-guaranteed securities or projects, Cagamas, (100% secured investments). The investment system in EPF is generally capable to achieve 6% within a six month period. If EPF allows the system to invest effectively, they would possibly achieve something like 8% to 10% ROI. Then, the following year, the system will have to be benchmarked at the higher ROI, and the investment managers will be stressed to perform and achieve at higher ROI, or at least to repeat similar performance. Of course, investment in higher return derivitives will be exposed to higher risk, which is a phobia within the institution. At such, EPF had chosen the easier way to maintain stability and safe returns on investment. They are basically risk-averse.

They call it BALANCE SCORECARD - don't score too high (play safe in order to be safe); Otherwise, they will be in trouble the next year as they will have to maintain a higher level of returns.

This is what Malaysians learnt - BALANCE SCORE-SHEET; NOT SCORECARDS!

Read an article from aisehman.org and maybe, EPF should come up with a better explanation:

On paper, [EPF's] roughly RM2.3 billion investment in listed Rashid Hussain Bhd is currently valued at about RM115 million , according to people familiar with the matter, making the investment one of the worst in the EPF's history. [Wall Street Journal: Another chill hits Malaysian business climate; subscription required]

At the crux of the affair is the dire financial health of RHB Bank's ultimate holding company, Rashid Hussain Bhd, in which Utama and the EPF own 32.8% and 31.7% stakes, respectively. Malaysian bankers say the Rashid Hussain group of companies urgently needs at least RM3 billion of fresh capital from its main shareholders to meet government capital-adequacy requirements.

The problem: The EPF would have to pour more of public funds into an already disastrous investment in order to bail out the group.

No comments:

Post a Comment