In Islam, usury is forbidden. PTPTN charged interests on education loan, declared The Star. Read further herebelow.

In Islam, usury is forbidden. PTPTN charged interests on education loan, declared The Star. Read further herebelow.Admin cost in education loan means interest

PTPTN has finally clarified that its use of terminology is different from that of conventional banking.

“The term ‘administrative cost’ in PTPTN loans is the same as the term ‘interest’ used in conventional banking systems,” said chief executive Yunos Abd Ghani in a statement on Friday.

“The use of the term ‘administrative cost’ is part of our efforts to introduce an education loan based on syariah principles in the near future.”

When you take a National Higher Education Fund Corporation (PTPTN) loan and are charged an administrative cost, you are, in fact, being charged interest on the loan.

“All PTPTN borrowers are informed of this administrative cost in their acceptance letters as well as when the loan documents are signed,” Yunos said.

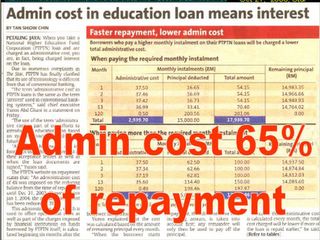

The PTPTN website on repayment states that: “An administration cost of 4% was imposed on the reducing balance from the time of repayment until Dec 31, 2003. However from Jan 1, 2004, the administration cost has been reduced to 3%.”

This administrative cost, which is used to offset operational costs as well as part of the charges imposed by financial institutions on funds borrowed by PTPTN itself, is calculated beginning six months after the borrower has graduated.

Yunos explained that the cost was calculated based on the amount of remaining principal every month. “When the borrower starts repayment, the administrative cost, including arrears, is taken into account first; any remainder will only then be used to pay off the principal. “Because the administrative cost is calculated every month, the total cost charged will be lower if more of the loan is repaid earlier,” he said.

Is Malaysia an Islamic State? If so, the system administrators charged interests and what they did in order to comply to Islamic principles is just to change the word interest to administrative costs, and it becomes OK? So, if things are haram, like liquor and gambling, can we just call it hard-stiumulating water and numbers games? Isn't that analogous with what PTPTN had done?

Well, now I learn something from Muslim officers. Why those Takaful bosses are not commenting about this? Making Deepavali wishes is haram, but charging interest in the name of admin cost is OK? Sounds interesting.

Is this called creative Islamisation? Don't be angry, what I am saying is Malaysian Muslim officers just do not understand the Holy Quran. They are making God in their own image, not what was elucidated in the Quran. The Quran is pure but the interpretors of it isn't. Take an example: Zakaria Deros and Mazlynoor Abdul Latiff’s Mansion - aren't what they did be unIslamic? Check the Quran and see what it said.

5 comments:

The whole scheme stinks. It's very misleading. Many students are grateful for it only because they have no other funding means to study at the university level.

I believe those ethical borrowers who faithfully repay their loans will be penalised to cover for those who default. It happens in the banking system too.

They're making a fool out of themselves. When I read this I thought "Admin cost = Interests... WTF??"

Why couldn't they just stick to the conventional banking term to save some embarrassment?

Then again, since this is a small hiccup let's just shake our heads, sigh and move on.

I think its fair enough la ptptn chrging only 3% interest. Who would lend you money for nothing?

gohkietrhee, these monies are from taxes, not their own personal... not a goodwill.

PTPTN are not helping us, they're making us living in debts. Can you imagine the amount of employed and unemployed graduates living in debts? About the 3% "admin cost" taken from each students, can you imagine how much PTPTN is making per month??? Millions.... Is this helping??? Isn't it enough taxing? Why charging so much?

Post a Comment