Harvard Business Review published the article “The Balanced Scorecard – Measures That Drive Performance” which was jointly written by Dr. David Norton (the then CEO of Nolan-Norton and now President of Balanced Scorecard Collaborative-BSCol) and Professor Dr. Robert Kaplan of the Harvard Business School.

The article summarized the findings from an in-depth study of 12 manufacturing and service companies that was carried out in 1990.

The research program set out to design a new approach to performance measurement that dealt with a growing managerial problem – that accounting, or financial, measures were increasingly being found wanting in assessing and managing organizational performance.

Norton and Kaplan premised that what business leaders required was a new mechanism with which it can take a holistic view of organizational performance, thus, providing more than the lagging financial metrics on which most organizations had based their decisions.

Consequently, Norton and Kaplan introduced a new performance measurement framework, which they anmed it:

The balanced Scorecard is a management system that enables organizations to clarify their vision and strategy and translate them into action. It provides feedback around both the internal business processes and external outcomes in order to continuously improve strategic performance and results. When fully deployed, the balanced scorecard transforms strategic planning from an academic exercise into the nerve center of an enterprise.

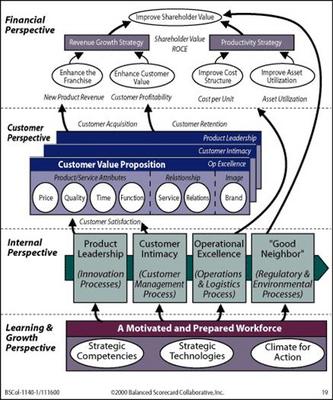

The Balanced Scorecard is basically a strategy management and implementation system that comprise a Strategy Map and an accompanying Balanced Scorecard of strategic measures, targets, and initiatives.

The Strategy Map serves as a strategy implementation roadmap in that it describes the high-level strategic objectives that the organization must deliver if it is to successfully execute its strategy.

Central to the premise of the Balanced Scorecard philosophy is that successful strategy implementation is the result of causal relationships within and between typically three non-financial perspectives and one financial perspective. The argument has it that succeeding against objectives from the learning and growth perspective (which forms the foundation of the Strategy Map) has a causal effect on success from the internal process perspective, which in turn creates success from the customer perspective and finally from the financial, or shareholder perspective.

Crucially, the Strategy Map and accompanying scorecard is a hypothesis. It is management’s best guess as to what is required to implement the strategy. The Balanced Scorecard basically provides a framework to translate a strategy into operational terms.

To understand and implement the Balanced Scorecard Management System, we first need to understand the five principles of the Strategy-Focused Organization (SFO). These principles as adopted and adapted by Norton and Kaplan, and are required for the successful strategy implementation.

The first principle is to translate the strategy to operational terms. It incorporates the framework for articulating strategic objectives, measures, targets, and initiatives. Strategy Map and Balanced Scorecard may be created at the enterprise-level and then devolved to the functional level.

The second principle is to secure synergistic benefits which require the explication of common themes and objectives than are developed at the organizational level. The components are corporate roles, business unit synergies, and shared service synergies.

The third principle is to make strategy everyone’s everyday job. This is where strategy is moved out of the boardroom and into backroom. Strategic awareness requires concerted, ongoing, educational, and communication efforts. The components are strategic awareness, personal scorecards, and balanced reward.

The fourth principle is to make strategy a continual process. The Balanced Scorecard is placed at the heart of the management system and it links budget to strategies which also calls for an inculcated strategic learning process. The components are budget and strategy linking, analytical and information systems, and strategic learning process which captures and act on strategic feedbacks.

The fifth and final principle is to mobilize change through executive leadership. In order to sustain the scorecard success, top management must introduce and champion the scorecard. Senior management must be galvanized behind the scorecard. The components are mobilization, governance process and strategic management systems.

The balanced scorecard methodology builds on some key concepts of previous management ideas such as Total Quality Management (TQM), including customer-defined quality, continuous improvement, employee empowerment, and primarily, measurement-based management and feedback.

You can't improve what you can't measure. So metrics must be developed based on the priorities of the strategic plan, which provides the key business drivers and criteria for metrics managers most desire to watch. Processes are then designed to collect information relevant to these metrics and reduce it to numerical form for storage, display, and analysis. Decision makers examine the outcomes of various measured processes and strategies and track the results to guide the company and provide feedback.

The goal of making measurements is to permit managers to see their company more clearly, from many perspectives, and hence to make wiser long-term decisions.

Modern businesses depend upon measurement and analysis of performance. Measurements must derive from the company's strategy and provide critical data and information about key processes, outputs and results. Data and information needed for performance measurement and improvement are of many types, including: customer, product and service performance, operations, market, competitive comparisons, supplier, employee-related, and cost and financial. Analysis entails using data to determine trends, projections, and cause and effect -- that might not be evident without analysis. Data and analysis support a variety of company purposes, such as planning, reviewing company performance, improving operations, and comparing company performance with competitors' or with 'best practices' benchmarks

A major consideration in performance improvement involves the creation and use of performance measures or indicators. Performance measures or indicators are measurable characteristics of products, services, processes, and operations the company uses to track and improve performance. The measures or indicators should be selected to best represent the factors that lead to improved customer, operational, and financial performance. A comprehensive set of measures or indicators tied to customer and/or company performance requirements represents a clear basis for aligning all activities with the company's goals. Through the analysis of data from the tracking processes, the measures or indicators themselves may be evaluated and changed to better support such goals.

1. The Learning and Growth Perspective

This perspective includes employee training and corporate cultural attitudes related to both individual and corporate self-improvement. In a knowledge-worker organization, people -- the only repository of knowledge -- are the main resource. In the current climate of rapid technological change, it is becoming necessary for knowledge workers to be in a continuous learning mode. Government agencies often find themselves unable to hire new technical workers and at the same time is showing a decline in training of existing employees. This is a leading indicator of 'brain drain' that must be reversed. Metrics can be put into place to guide managers in focusing training funds where they can help the most. In any case, learning and growth constitute the essential foundation for success of any knowledge-worker organization.

Kaplan and Norton emphasize that 'learning' is more than 'training'; it also includes things like mentors and tutors within the organization, as well as that ease of communication among workers that allows them to readily get help on a problem when it is needed. It also includes technological tools; what the Baldrige criteria call "high performance work systems." One of these, the Intranet, will be examined in detail later in this document.

2. The Business Process Perspective

This perspective refers to internal business processes. Metrics based on this perspective allow the managers to know how well their business is running, and whether its products and services conform to customer requirements (the mission). These metrics have to be carefully designed by those who know these processes most intimately; with our unique missions these are not something that can be developed by outside consultants.

In addition to the strategic management process, two kinds of business processes may be identified: a) mission-oriented processes, and b) support processes. Mission-oriented processes are the special functions of government offices, and many unique problems are encountered in these processes. The support processes are more repetitive in nature, and hence easier to measure and benchmark using generic metrics.

3. The Customer Perspective

Recent management philosophy has shown an increasing realization of the importance of customer focus and customer satisfaction in any business. These are leading indicators: if customers are not satisfied, they will eventually find other suppliers that will meet their needs. Poor performance from this perspective is thus a leading indicator of future decline, even though the current financial picture may look good.

In developing metrics for satisfaction, customers should be analyzed in terms of kinds of customers and the kinds of processes for which we are providing a product or service to those customer groups.

4. The Financial Perspective

Kaplan and Norton do not disregard the traditional need for financial data. Timely and accurate funding data will always be a priority, and managers will do whatever necessary to provide it. In fact, often there is more than enough handling and processing of financial data. With the implementation of a corporate database, it is hoped that more of the processing can be centralized and automated. But the point is that the current emphasis on financials leads to the "unbalanced" situation with regard to other perspectives.

There is perhaps a need to include additional financial-related data, such as risk assessment and cost-benefit data, in this category.

It must be noted that no strategy can last forever. New strategic focus must be redefined to take the organization beyond doing its best and sustaining competitive advantage in the global marketplace.

Many companies who had implemented the scorecard system had derived substantial benefits. As an example, Saatchi & Saatchi who was on the verge of bankruptcy in the 1990s, brought in a new senior management team and implemented the SFO and Balanced Scorecard system. They managed to achieved their financial revitalization six months ahead of schedule and the company was sold to Publicis Groups SA of France for more than $2.5 billion, which is 4.5 times its net worth. Other examples are MTR Corporation, Tata Motors, Gold Coin, Cigna Property & Casualty, Mobil Oil, Hilton Hotels, Scandia Insurance, Bank Universal, Centrepoint Properties, Singapore prison Service, and AT & T Canada.

In Malaysia, to my knowledge, the big names who had implemented the scorecard system include EPF, Petronas, DRB-HICOM, AmBank Group, Northport, Sunway Group, Negara Properties, and Pos Malaysia. It will be interesting to see the success story of these companies in relation to its implementation and its corporate restructuring exercise.

However, management must realize that merely possessing a Balanced Scorecard will not in itself deliver benefits. The Scorecard is not something that organizations can plug and play. It is not a software that will automatically implement strategy, or fix a broken organization, nor rectify a dysfunctional system. A bad management team will not be converted to good with the scorecard. The fundamental of successful implementation is the quality of the leadership which is central to achievement. Those organizations that are looking for quick fixes will in fact imbue more problems and generate far greater chaos. Another reason for failure is the management’s inability to built capability to sustain the program.

A final point of advice to those implementing this initiative: “Nothing can kill the scorecard system quicker than a CEO waxing lyrical about the critical importance of non-financial measures and then demanding that heads roll when financial results are down. Similarly, if financial resources are not dedicated to scorecard implementation, the initiative will be short-term and would die a ‘natural death’. It must be noted that for this program to be successful, CEO and his senior executives must give unconditional and unequivocal backing; otherwise, don’t bother to spent money on such program.

It must be stressed that the scorecard’s survival is the consequence of its careful observation of the basic rule of continued existence of which it will evolve. Given the speed of change in the global competitive environment, organizations innovate with ‘first-mover’ advantage or developing products or capabilities that are ahead of competitors will be able to reap substantial financial benefits and at the same time, crushed their competitors.

References & Recommended Readings:

Robert S. Kaplan & David P. Norton; The Balanced Scorecard; Harvard Business School Press; 1996

Robert S. Kaplan & David P. Norton; Strategy Maps: Converting Intangible Assets into Tangible Outcomes; Harvard Business School Press; 2004

Paul R. Niven; Balanced Scorecard - Step-By-Step: Maximizing Performance and Maintaining Results; John Wiley & Sons Inc; 2002

Mike Bourne & Pippa Bourne; Balanced Scorecard in a Week; Hodder & Stoughton; 2000

James Creelman & Naresh Makhijani; Mastering Business in Asia: Succeeding with the Balanced Scorecard; John Wiley & Sons (Asia) Pte Ltd; 2005

1 comment:

Hi,

I came across your blog recently as I was doing some research on strategy maps. I had a few questions and was wondering what would be the best way to get in contact with you to discuss a few of them?

Thanks!

Bobby

bpham@activestrategy.com

Post a Comment