Finally, the good corporate citizen admitted and paid tax to the Chad government amounting to some RM1.04 billion (USD281.6 million).

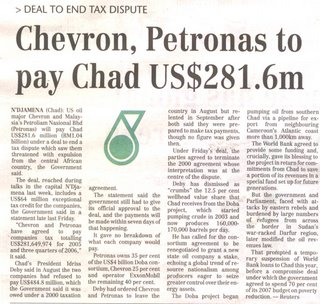

Finally, the good corporate citizen admitted and paid tax to the Chad government amounting to some RM1.04 billion (USD281.6 million).Chevron and Petronas agreed to pay Chad US$281.6 million (RM1.04 billion) under a deal to end a tax dispute which saw them threatened with expulsion from the central African country, the Chad Government said.

"Chevron and Petronas have agreed to pay companies tax totalling US$281,649,974 for 2005 and three quarters of 2006," it said.

Chad's President Idriss Deby said in August the two companies had refused to pay US$484.8 million, which the Government said it was owed under a 2000 taxation agreement.

The statement said the government still had to give its official approval to the deal, and the payments will be made within seven days of that happening. It gave no breakdown of what each company would pay.

Petronas owns 35 per cent of the US$4 billion Doba consortium, Chevron 25 per cent and operator ExxonMobil the remaining 40 per cent.

According to D-G of IRB, Tan Sri Zainol Abidin Abd Rashid, Petronas is a responsible tax payer. “There is no reason for Petronas not to pay tax and hurt its own reputation,” Zainol said. “I don’t believe that Petronas would have done that as it is an international class company and the sole local company listed on the Fortune 500.”

If that's true, by agreeing to pay the RM1.04 billion now, wouldn't it constitute an admission of guilt?

If that's true, by agreeing to pay the RM1.04 billion now, wouldn't it constitute an admission of guilt?

Or, is this something we call....goodwill???? or, kautim? or, over-the-table? or, NEP???

6 comments:

Kaw tim liao lah! See where Chad ranks in the corruption index...

Korek chib*i also kena bayar, inikan pulak minyak Chad, hahahahah!

They are sounding like they have a choice....

1. US oil major Chevron and Malaysia's Petroliam Nasional Bhd (Petronas) will pay Chad US$281.6 million (RM1.04 billion) under a deal to end a tax dispute which saw them threatened with expulsion from the central African country, the Government said. (Business Times, 9th Oct 2006)

2. According to D-G of IRB, Tan Sri Zainol Abidin Abd Rashid, Petronas is a responsible tax payer. “There is no reason for Petronas not to pay tax and hurt its own reputation,” Zainol said. “I don’t believe that Petronas would have done that as it is an international class company and the sole local company listed on the Fortune 500.”

I learned about "deduction" method from the Mathematics classes that I have attended under the great Malaysia education system. This is how I apply the technique, "If statement 1 is true, then Petronas is a f*ck-up company since they earned billions from the country but not paying tax", else, "ZA from statement 2 must be bull-shitting since Petronas has already admitted to the tax dispute". Did I score a 100 marks or 0?

All these statements sound so faimiliar to me, what does "the sole local company listed on the Fortune 500" has to do with not paying tax? The same goes to when Muhyiddin's claim on the equity dispute that ASLI's report is "rubbish", simply because it "challenges the government authority". Maybe the local company and government has grown so great that people start worshipping it.

Those from Singapore can easily put this in a very straightforward, simple term "tok kok, sing song". Let's Karaoke.

O2Deprivation, you score 100 marks! Price: CEO of the Year!

Thanks Maverick, not too sure what are the chances of getting a scholarship with that 100 marks? Need to get MCA's help to beg for one I guess.

Post a Comment